Regulations on cash registers in Germany were proposed from July 2016 by the tax authorities. Specifically, all cash registers in Germany will be protected against manipulation before January 1, 2020. In particular, the remarkable point in this KassenSichV Act is the standardization of DSFinV-K and the installation of TSE (Technical Safety Equipment), which helps the entered data can not be changed or deleted afterward.

-

Introduction to DSFinV-K

1.1. What is DSFinV-K?

This is a data structure and data export recommendation to ensure that the provision of the data for the external cash register evaluation as well as the cash register evaluation is completely consistent. This can help supervisors check the cash register’s data more easily and conveniently because:

- The data in the cash register is synchronized

- All recorded data in the system is exportable

- The data structures in the cash register can be converted to other software for checking financial accounting

1.2. What is new in version DSFinDSFinV- K 2.0?

With version 2.0, DSFinDSFinV-K is equipped with auditing software of tax authorities to minimize errors and fasten the implementation process. It would be a big plus for F&B business models that are using restaurant POS devices that operate to this standard, especially during field checks. However, this is completely not compulsory for the cash registers.

-

Introduction to TSE

2.1. What is TSE?

- Technical safety device (abbreviation: TSE) is a technical safeguard against digital record manipulation.

- The obligation to have a TSE is a part of the KassenSichV act, becoming effective throughout Germany since 2020. In addition to the obligation to issue invoices and register a cash register, TSE is the most notable point of this act.

- TSE will help prevent the alteration or deletion of records that you have made with the cash register system, ensuring that all individual records are properly and completely saved. This is such safe storage that all data saved in it can not be changed anymore.

- Besides, thanks to TSE, financial management regulators can access your stored data quickly and easily.

- All digital and non-digital cash registers must have TSE certified by 2020

2.2. Types of TSE

There are many types of TSE on the market today, including:

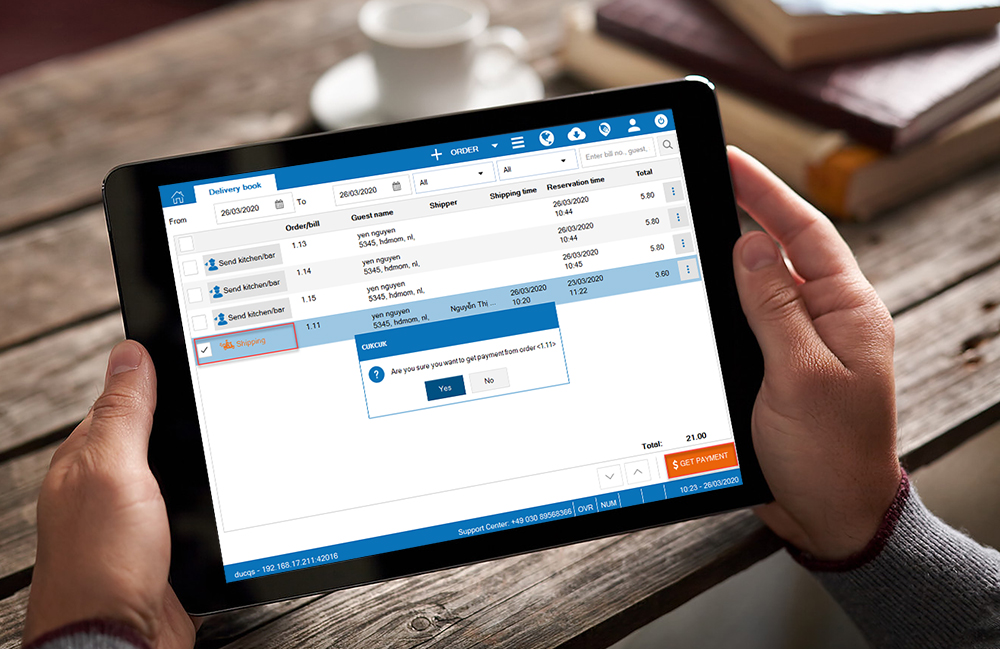

- Cloud TSE: In the case of a POS system connecting to 1 TSE in cloud-based form, all basic records will be automatically saved to the cloud via the Internet. Therefore, you can access data anytime and anywhere.

- USB/ SD Card: TSE is directly connected to the POS system via USB or SD socket. All necessary basic recordings are recorded and saved on external storage.

- Receipt printers with TSE: Epson offers 2 Printer lines (Thermodrucker) that can be equipped with TSE (not all printers can have TSE integrated).

- TSE network: In case there are multiple cash registers in a common network, TSE manufacturers recommend using a device called “Box TSE”. The “Box TSE” is integrated into your network so that all cash registers can be linked to the TSE – hub.

2.3. Mechanism of action of TSE

Detailed requirements for the TSE were developed by the Federal Office for Information Security (BSI), and outlined in technical manual TR-03153. In which, BSI stipulates that a certified TSE must ensure all three components as follows:

- Security Module: The security module consists of two components: SMA (Security Module Application) and CSP (Cryptocurrency Service Provider). Its purpose is to ensure that all inputs are fully logged when recording starts. Besides, the security module ensures that your records in the checkout system are not altered or deleted without being unnoticed.

- Storage device: According to GoBD, you must store all digital records for 10 years. The storage facility of technical security equipment must ensure compliance with this statutory storage period.

- Unified digital interface: An export interface must ensure smooth data transmission. Thanks to a standardized digital interface, it is possible to export all the archived records quickly and easily – especially for tax authorities.

2.4. Deadline for installing TSE

Due to the effects of the Covid-19 pandemic, as well as the adjustment of the new sales tax rate, many models have difficulty in applying TSE to their cash register. 15 states (with the attached list) also clearly stated their difficulties to extend the deadline until March 31, 2021. Specifically, the following cases that are not subject to complaints are:

- The company must place a binding order or contract and be able to verify the required amount of TSE with a cash register specialist or other service providers by September 30, 2020 (Sachsen, Rhineland Palatinate, and Lower Sachsen: August 31, 2020).

- Cloud-based TSE installation is planned and not available yet. Unavailability must be proved by appropriate documentation.

The evidence must be retained in a general retention period and presented upon request.

Notwithstanding the above relief, there are still technically necessary adjustments and upgrades of the electronic recording system must be immediately made and meet legal requirements right away.

List of states postponed installing TSE:

-

- Mecklenburg-Vorpommern

-

- NRW

-

- Baden Württemberg

-

- Saarland

-

- Sachsen

-

- Niedersachsen

-

- Schleswig Holstein

-

- Hamburg

-

- Thüringen

-

- Rheinland Pfalz

-

- Sachsen-Anhalt,

-

- Berlin

-

- Brandenburg

-

- Hessen

-

- Bayern